Reviews Tripe a Car Insurance John Kolias Las Vegas

UPDATED: April 1, 2022

Advertiser Disclosure

It's all about you. We want to help you make the correct coverage choices.

Advertiser Disclosure: We strive to help you brand confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any i machine insurance company and cannot guarantee quotes from whatsoever single company.

Our partnerships don't influence our content. Our opinions are our own. To compare quotes from top car companies please enter your Nothing lawmaking above to use the gratuitous quote tool. The more than quotes you compare, the more chances to salvage.

Editorial Guidelines: We are a gratis online resource for anyone interested in learning more virtually auto insurance. Our goal is to be an objective, tertiary-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

You've tried everything.

Yous've spent what seems similar countless hours surfing the spider web, trying to find car insurance providers with the best rates to meet the needs of all the drivers in your family. Yous probably feel like if you have to look at one more insurance website, your computer screen might burst into flames.

If some or all of this describes you in any style, this comprehensive guide is for you.

If you are i of the over ii.94 meg individuals currently residing in the state of Nevada, finding the Nevada car insurance policy you want at affordable rates is ane of the unmarried nearly important decisions yous'll ever make. When you consider that 10.6 percent of all Nevada drivers on the route are uninsured, the necessity of protecting all the drivers in your family in case of an unexpected collision is all the greater.

The skilful news is in that location's a much simpler mode to detect the right Nevada car insurance provider for your family without wasting hours of your valuable time stressed out, staring at a screen. Today, we will walk you through everything you need to know nearly Nevada car insurance coverage and rates, carriers, driving laws, vehicle licensing laws, safety laws, and and so much more.

First things first, set yourself on the route to success to relieve big with Nevada car insurance carriers. Access your comprehensive rates quote all in i place. Compare rates now with our Costless calculator!

Alright, ready to dive into Nevada machine insurance coverage and rates? Permit'south go!

Nevada Car Insurance Coverage and Rates

While most people's minds spring straight to Las Vegas when thinking about Nevada, in that location's then much more to The Silver State besides the Entertainment Capital of the Globe. While about three-quarters of Nevada residents alive nearby Las Vegas, residents accept no shortage of natural and manmade wonders to behold outside the city.

From the stunning Valley of Burn State Park in Overton to the green Spring Mountain National Recreation Surface area to the famous Cherry-red Rock National Conservation Expanse to Lake Tahoe, the Silverish Country is an outdoor lover'southward playground.

With its arid climate, Nevada stands as the driest land in the land receiving less than 10 inches of rain annually. The Silver State is the seventh-largest state in terms of country mass out of the unabridged country, but approximately 86 percent of the land belongs to the federal authorities.

Fun fact! While the state of California is often called the Golden Country, the bulk of gilt in the USA actually comes from Nevada. The state of Nevada is likewise one of a handful of states that charge zero private income tax or corporate revenue enhancement.

Whether you're because packing your bags and moving to The Silver Land or have lived there all your life, agreement your Nevada car insurance coverage and price options is a must.

So, let'south begin!

Nevada Minimum Automobile Insurance Coverage Requirements

The tabular array above details the minimum Nevada automobile insurance liability coverages required under state law. The chart beneath volition show how much minimum coverage costs in Nevada and other states.

Simply, what does this all hateful? Let's accept a closer await.

- $25,000 per person— to cover the bodily injury or death of whatever individual resulting from an accident the vehicle possessor/driver causes

- $50,000 per accident— to cover total bodily injury or decease liability resulting from an blow the vehicle owner/driver causes

- $20,000 per accident— to embrace the total property damage resulting from an blow the vehicle owner/driver causes

In uncomplicated terms, liability coverage exists to cover things like property harm expenses, medical bills, and other costs incurred by any commuter, rider, or pedestrian who suffers damages in an accident you are responsible for.

Information technology is wise to consider carrying policy coverages in a higher place the minimum required amount. Nevada, like most other states, adheres to the "fault system". In the state, whoever causes an auto blow is responsible for whatever ensuing damages. In a practical sense, this means that your insurance visitor will cover the costs of any damages incurred by victims in a crash you cause up to and until your policy limits are wearied. In one case those limits are exhausted, you are personally liable for any additional damages.

Your liability coverage will also apply if a member of your family is driving your car or if yous allow someone else use it. Here'south a helpful video that explains liability insurance in Nevada further.

An important signal to bear in mind is the fact that your liability coverage does non cover any damages you incur if someone else causes the standoff and yous endure injuries or belongings damage. This is where boosted coverage options like MedPay, PIP, and collision coverage are valuable. We'll touch on more on these further down.

One thing you need to know is that Nevada takes a very strict arroyo to drivers who neglect to maintain the minimum coverages required nether land law. Nevada has zip grace flow. Fifty-fifty a lapse every bit seemingly insignificant as 1 day could pb to having your registration suspended, plus a $251 reinstatement fee at the very minimum.

Nevada adheres to a tiered system that assesses uninsured driver penalties and fines based on the length of the coverage lapse and how many times (if any) the private has allowed coverage to lapse previously. Long story brusk, don't skimp on coverage and e'er acquit and maintain at least the minimum liability amounts required under Nevada automobile insurance laws.

Mandatory Forms of Fiscal Responsibility in Nevada

Nevada has a unique system they utilise for insurance verification purposes known as the LIVE program. The Live programme allows the Nevada DMV to verify a commuter's current coverage in real time. Withal, you are still required to behave proof of financial responsibility or proof of insurance with you in your automobile at all times.

If you lot are ever pulled over by an officeholder in Nevada and cannot offer proof of insurance, you will be cited. Your insurer-issued proof of coverage card, showing your name, policy number, policy expiration appointment, and National Association of Insurance Commissioner'southward (NAIC) license number is one easy pick.

Yous are also immune to show digital proof of insurance to a responding offering by keeping the data on your phone. Information technology just needs to be clear, easy to read, and include all the details your hard copy carte du jour would.

Premiums as a Percentage of Income in Nevada

Based on the most contempo data from 2017, the average annual personal income per capita for a Nevada resident is $46,159. A person's per capita income is what they keep later taxes to spend or save as needed.

Compare that against the average annual cost of Nevada auto insurance which is approximately $one,100, and you'll run into that car coverage comprises around two.4 percent of residents' total income. This means that the typical Nevada resident brings abode near $3,850 a month to pay things like the rent, mortgage, utilities, food, and other costs. Your monthly Nevada car insurance nib subtracts about $92 from that.

While this figure might seem small, numbers add up over time and this is only the boilerplate amount you tin wait to pay. For instance, factors like your driving history and any coverage lapses can spike your annual and monthly rates considerably. Past keeping at to the lowest degree the minimum liability coverages on your policy current, you'll save on costs and needless headaches in the long run.

Boilerplate Monthly Motorcar Insurance Rates in NV (Liability, Standoff, Comprehensive)

The table above contains the nearly recent information gathered by the NAIC in 2015. Expect Nevada car insurance rates to spike significantly in 2019 and moving forrad from what you lot see hither. Nosotros've already discussed that liability coverage serves to cover any damages incurred by some other party or parties if you get into an accident and are responsible for the collision.

While not mandatory under current Nevada car insurance laws, standoff coverage offers you protection for damage to your auto, no matter who the at-fault political party is. Collision coverage covers the price of repairs or provides y'all with a stipend in the consequence of a loss.

Comprehensive coverage insures you in case of theft or harm to your vehicle from outside elements, such as falling objects, a flood, or fire. Another type of car insurance you might want to consider if yous have multiple drivers and vehicles in your family is combined coverage. Combined automobile insurance allows you to list all your vehicles on a single policy for a cost-effective plan.

Prepare to learn what your boosted liability coverage options in Nevada are? Allow'due south go!

Additional Liability Coverage in Nevada

The video higher up explains why you should consider coverages across the minimum amounts required under land law. Cheque it out!

The tabular array below indicates the average loss ratio of Nevada car insurance carriers for certain types of boosted coverage, compiled from the NAIC'south well-nigh contempo consumer information. An insurance carrier'due south loss ratio equals the percentage of losses they experience against the premiums they earn.

As yous can see in the stats listed above, Nevada car insurance companies sustained loss ratios over 100 percent for uninsured/underinsured motorist coverage just dipped back beneath the 100 percent mark in 2015. When an insurance company sustains a loss ratio over 100 percent, this reveals that they are paying more than money out in claims than they are getting back in client premiums. So, if a carrier continues to have a loss ratio to a higher place 100 pct, that's a pretty bad sign.

On the other hand, the table above also shows that Nevada auto insurance companies are enjoying average gains to losses in a healthy range for MedPay coverage. The NAIC'southward contempo study did non include any data for PIP (Personal Injury Protection) loss ratios. Check out their 2018 Auto Insurance Database Study to larn more.

Remember when we talked about how liability insurance doesn't pay for whatever injuries yous sustain if yous get into a wreck? Well, MedPay and Personal Injury Protection (PIP) pay for the costs of injuries sustained by either y'all and/or your passengers if an accident occurs, regardless of who caused information technology. MedPay and PIP also provide coverage if you are a pedestrian who is hit by a car.

Uninsured/underinsured motorist coverage offers yous protection if you get into an accident with another commuter (who is at fault), but that individual does non have insurance or maintains unsufficient coverages to pay the full corporeality of your claim.

Nevada currently ranks 29th in the nation for uninsured motorists. So, while these coverage add-ons might exist optional, it is in your best interest to consider maintaining them equally function of your Nevada motorcar insurance policy.

Add-ons, Endorsements, and Riders

Besides add-ons like MedPay and uninsured/underinsured motorist coverage, there are more coverage options you lot might want to consider including in your Nevada auto insurance policy.

Check these out!

- Personal Umbrella Policy (PUP)

- Guaranteed Auto Protection (GAP)

- Emergency Roadside Assist

- Rental Reimbursement

- Mechanical Breakup Insurance

- Pay-Equally-You-Drive or Usage-Based Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Average Monthly Car Insurance Rates past Historic period & Gender in NV

In the 2 tables below, you will detect data our researchers gathered from Nevada car insurance providers statewide to see if gender and historic period fabricated a noticeable divergence in rates. Men are often charged higher annual car insurance rates than women, with teen drivers usually having the highest rates of all.

Let'due south see what our researchers discovered!

Demographic and Insurance Carrier

As you'll notice in the table above, well-nigh insurance companies accuse 17-yr-old male and female drivers significantly higher rates than the rest of the driving population. For instance, Allstate charges 17-twelvemonth-sometime male person drivers nearly $13,000 in annual premiums, while they only charge 25-yr-sometime male drivers approximately $four,000. That'south a about $9,000 premium difference!

For other companies, the rate difference isn't quite so extreme. Take USAA, for example. Teen commuter rates are still the highest, but only a few chiliad dollars more than other demographics in near cases.

Teen drivers aside, the rate difference betwixt other age groups and genders isn't typically too wide. For instance, carriers like Mid-Century Insurance Visitor only accuse 35-year-old male drivers almost $90 more in annual premiums than female drivers of the aforementioned age. On the other paw, Nevada machine insurance companies like American Family unit Mutual charge 35 and sixty-year-old drivers the exact same rates, regardless of gender.

As you tin can see, different insurance companies have different approaches to determining the premiums they charge insureds. In many cases, age is an even more than important factor than gender.

Rank by Demographic and Insurance Carrier

Highest and Everyman Rates in Nevada by Aught Code

The table above reveals the highest and everyman Nevada car insurance visitor rates statewide based on ZIP code. Use the search bar to find your Zip code and find what insurance providers charge in your expanse.

Almost Expensive/Least Expensive Carrier Rates by City

Employ the search bar for the table higher up to find the average carrier rates for your city! It's interesting to note, that large cities like Las Vegas tend to have much higher carrier rates than smaller towns similar Fallon. As our researchers discovered, location can definitely exist a significant cistron in the insurance rates carriers charge.

Best Nevada Auto Insurance Companies

Gear up to observe the best Nevada car insurance companies statewide? From the superlative carriers' financial ratings to Nevada insurers with the best client ratings to those with the almost complaints, y'all won't want to miss this.

Let's go this show on the route…

The x Largest Nevada Car Insurance Companies' Financial Ratings

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Subcontract Grouping | A++ |

| Geico | A++ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| Farmers Insurance Group | A |

| USAA Group | A++ |

| Liberty Mutual Group | A |

| CSAA Insurance Group | A |

| American Family Insurance Grouping | A |

| Hartford Fire & Casualty Group | A+ |

Nevada Auto Insurance Companies with the BEST Client Ratings

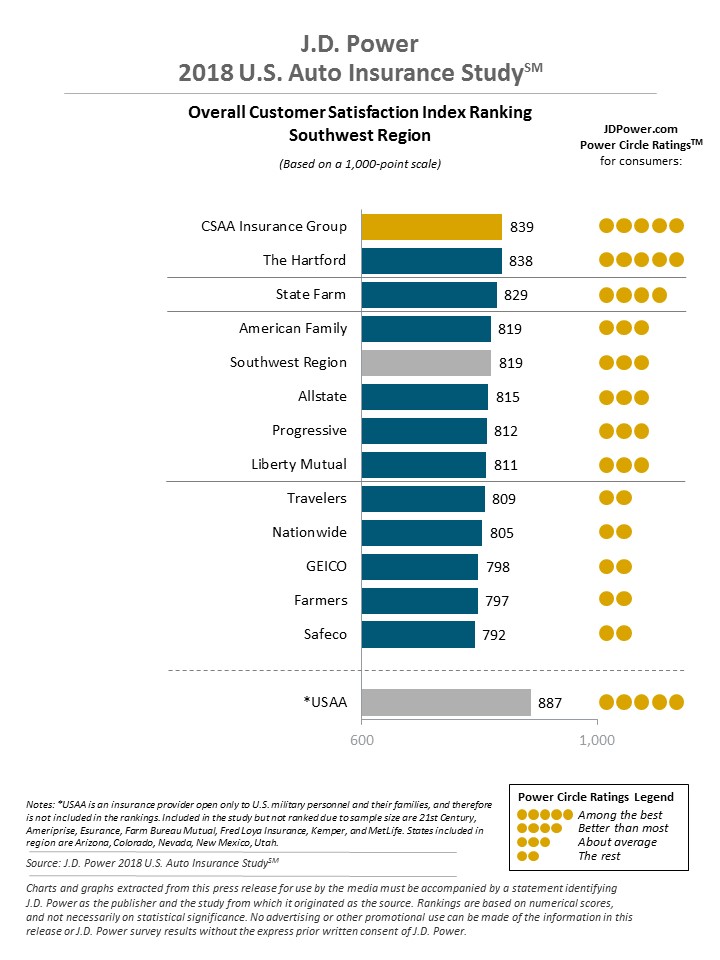

Every year, J.D. Ability releases its annual U.S. Auto Insurance Study for overall customer satisfaction across the country. Accept a look to encounter how your electric current insurance carrier rates!

Nevada Car Insurance Companies with the Virtually Client Complaints

Below are the Nevada Car Insurance Companies with the well-nigh consumer complaints, taken from the Nevada Division of Insurance's 2018 Consumer Complaint Report. Check to run across where your current insurer or any company yous're currently because ranks.

Conduct in mind, customer complaints are often an indicator of overall customer satisfaction, so this should exist one of many factors you accept into account when choosing a car insurance carrier.

Fourth dimension to dive into machine insurance rates by visitor!

Nevada Car Insurance Rates by Company

Of course, rates are probably the showtime affair you think of when determining whether a car insurance carrier is right for y'all. The table to a higher place shows ten of the top Nevada car insurance companies, including their boilerplate rates against the state average.

Our researchers discovered that Safeco charges the highest annual premiums and USAA the lowest. If yous pay close attending, you'll observe there'southward an over $3,000 annual rate difference betwixt the two!

Commute Rates

As yous can see in the table above, some, merely non all, providers adjust your Nevada car insurance rates based on the commute. For example, companies similar Farmers and Liberty Mutual charged insureds with both x and 25-mile commutes the verbal aforementioned rates.

However, carriers similar State Subcontract show an over $300 rate differences for insured individuals with 10 vs. 25-mile commutes. Pretty interesting, correct?

Accept a look at some of the other factors that are taken into consideration when determining your rates.

Coverage Level Rates

Credit History Rates

The fact of the matter is, except for a scattering of states where the practice is illegal, virtually states (including Nevada) let car insurance companies factor your credit history into the flick when determining rates. A study conducted by Experian discovered that the average Nevada resident has a VantageScore of 655 with approximately three.18 credit cards to their name and a balance of $vi,401.

If you have tons of credit carte du jour debt building upward, insurance companies typically see this as a sign that you might not be then probable to pay your monthly car insurance bill on time. Therefore, a bad credit score often translates to high auto insurance rates.

The practiced news is, by practicing healthy credit card usage habits, not spending more you can pay off in whatsoever given month, and paying your bill on time, you tin can increment the likelihood of getting better rates considerably.

Alright, now it'south time to see how top Nevada automobile insurance companies appraise insureds' rates based on their driving record. Let's spring into it!

Driving Record Rates

Your driving tape is another major factor Nevada machine insurance companies take into account when assessing your rates. That said, the disparity in rates between a clean record vs. something similar a DUI really depends on the insurance company.

Take Travelers and USAA for example. Travelers has an approximately $three,400 rate gap for insured drivers with a clean tape vs. a DUI. On the other hand, USAA charges drivers with one DUI on their record about $2,000 more per year than individuals with a clean record.

This video explains the furnishings of your driving record on your insurance rates in greater detail. Cheque it out!

Time to delve into the ten largest automobile insurance companies in Nevada, including cardinal stats regarding their written premiums, loss ratio, and market place share.

The 10 Largest Auto Insurance Companies in Nevada

Number of Car Insurance Providers in Nevada

Driving Laws in Nevada

Also finding the all-time coverage and affordable Nevada car insurance carrier rates, agreement the driving laws is your state is disquisitional to stay rubber whenever you get behind the wheel.

Time to go downwardly to business organisation.

Nevada'due south Motorcar Insurance Laws

Every bit of July 1, 2018, all Nevada drivers are required to carry the minimum liability coverage amounts of 25/50/20 as opposed to the liability insurance amounts that had been authorized for the iii decades prior of 15/30/10. Current Nevada auto insurance laws also prohibit the use of handheld devices as well as texting while driving.

Ready to learn all nearly key car insurance laws in your state? Let'due south get!

High-Adventure Insurance

If your driving record is less than stellar from numerous violations such as accidents or traffic citations, you might notice it difficult to obtain automobile insurance coverage. At the very least, you'll probably notice yourself facing some pretty steep rate options. If this situation describes you, yous might qualify for high-risk insurance.

A number of states have high-chance insurance programs for drivers and Nevada is no exception. Nevada'due south high-run a risk pool for drivers is known as the Western Clan Automobile lnsurance Programme.

High-hazard plans typically assign y'all an insurer, rather than yous being able to pick your own company. What'south more, you must meet certain eligibility requirements in gild to even authorize for a high-run a risk automobile insurance plan. Visit the Nevada Western Association Automobile Insurance Plan's website for more information.

Low-Cost Insurance

A handful of states offer low-cost insurance through special authorities programs to individuals who encounter a sure income threshold, are on disability, and/or run across item qualifying factors. However, Nevada does not offer any such programme at this time.

Windshield Coverage

A number of U.S. states crave a waived deductible for windshield repairs, while some only allow you to utilize manufacturer replacement parts. Yet, Nevada does not have any laws specific to windshields. Just be aware, that while insurers may not require you to rent a particular repair shop, you might have to make upwardly the difference cost-wise.

If you want your vehicle to take windshield coverage, be certain to purchase comprehensive coverage when selecting your Nevada auto insurance policy. See how different carriers handle potential windshield claims to run across which suits your driver needs best.

Automobile Insurance Fraud in Nevada

Check out the video above for an caption of machine insurance fraud in Nevada and what your legal options are in the event of such a accuse.

In the land of Nevada, automobile insurance fraud is considered a Category D felony, with penalties including upwards to four years imprisonment and fines up to $5,000. If bedevilled, individuals may likewise be required to pay restitution to the victimized party or entity.

Insurance fraud is typically when someone files an untrue or exaggerated claim with their insurance company in order to receive benefits or payouts. Here'southward a quick overview of actions that are considered insurance fraud in the state of Nevada under the Nevada Lawmaking section 686A.2815:

- Offering a argument to an insurer that you know hides or leaves out certain facts, or includes untrue or deceptive data about any matter pertinent to an insurance policy being issued

- Offering a statement to receive a payout or other insurance do good that you know hides or leaves out certain facts, or includes untrue or deceptive information almost any matter pertinent to that claim

- Helping, engaging, or plotting with some other individual to make a simulated or deceptive statement to an insurance company in order to make a payment claim, have a policy issued, or receive some other type of benefit

- Knowingly and willfully acting with the intention of misleading or defrauding an insurance company to receive a policy or type of benefit under the policy

- Willingly accepting an insurance policy benefit while knowing that the benefit was issued due to a deceptive or simulated statement or act every bit mentioned previously

The proficient news is, if yous don't commit insurance fraud, you lot've got nil to worry about!

Statute of Limitations

Each state has a set statute of limitations or the length of time you accept to file a lawsuit. Bear in mind, the statute of limitations is not the fourth dimension frame in which you must file an insurance merits with your Nevada car insurance carrier if you get into an accident. If you ever are involved in an auto collision, nearly insurance companies will require you to file a claim within a reasonable menstruation, commonly within a few days or weeks of the upshot.

In the state of Nevada, the statute of limitations for automobile accident injuries is ii years. If y'all get into an car accident acquired by another driver and sustain injuries as a consequence, you have 2 years from the date of the collision to file with the courts.

The aforementioned goes for a wrongful death personal injury case related to an auto accident. If someone is killed as the upshot of an auto collision, their family has ii years in which to sue on their behalf.

The statute of limitations for civil suits related to belongings harm sustained in an auto crash is three years. This means that if you get into an auto blow caused by someone else'due south negligent driving and your car is damaged as a result, you lot have three years from the date of the blow to file your claim.

Nevada's Modified Comparative Negligence Rule

Non all car blow cases are created equal. At that place are some instances where the mistake may clearly lie with ane party and others where both parties may behave a portion of the fault. This is where Nevada's modified comparative negligence rule comes into play. These laws help parties reach a fair settlement that is equitable for everyone involved.

Modified comparative negligence assesses liability to the parties who carry the most fault in a standoff. Nether Nevada Revised Statute 41.141, bearing a modicum of fault in an auto accident doesn't necessarily inhibit y'all from receiving a certain corporeality of damages in a personal injury matter.

Based on this constabulary, you can nevertheless exist awarded amercement even if you were partially responsible for causing the blow. If y'all are fifty per centum or less at fault for the accident, you can still recover damages. Notwithstanding, if you are over 50 percent at fault for the accident, y'all will not be able to recover whatsoever damages.

Nether Nevada's modified comparative negligence rule, the corporeality of damages you are awarded would be reduced past the per centum of fault you are allocated for the accident. For example, if you are thirty percent at error, you lot tin can even so receive 70 percent of your awarded damages. So, if your total awarded damages are $100,000, you would receive $lxx,000.

Nevada's Vehicle Licensing Laws

Fix to learn about Nevada's vehicle licensing laws? It is essential to know and understand these laws to ensure you comply with electric current regulations and stay prophylactic on the route.

Let'southward have a closer look…

Penalties for Driving Without Insurance

It is illegal to drive in Nevada without current car insurance. The penalties you can await to pay for driving uninsured range between $250 and $i,000, depending on the length of the coverage lapse. Other penalties include revocation of your driver'due south license, with reinstatement fees between $250 and $750.

The Nevada DMV's LIVE (Liability Insurance Validation Electronically) arrangement is a valuable tool regime and police enforcement officials use to place if a commuter is in compliance with insurance regulations in real time. So, if you are pulled over and the responding officer asks you for proof of insurance, he or she can compare your insurance ID against the Alive system to confirm everything is current.

Acceptable proof of insurance forms are:

- A valid insurance ID card

- The declarations page of your vehicle's current insurance policy

- You may as well provide this information electronically via your mobile device as long as it includes all the necessary details named in the prior documents and is readable

Long story curt, you don't want to exist caught without car insurance in Nevada.

Nevada has various penalty levels based on the length of your coverage lapse. Inside the initial 30 days of a coverage lapse, your license will be suspended but no fines would exist incurred.

For coverage lapses between 31-xc days, you will incur a $250 fine. For coverage lapses between 91-180 days, you will exist fined $500. The fine for drivers who have been driving 181 days or longer without insurance is $1,000. In add-on to these fines, their driver's license will be revoked until proof of insurance is provided to the Nevada DMV.

If yous are charged for having a coverage lapse beyond 91 days, your insurer will be required to file an SR-22 form to have your license reinstated. This means that your insurance premiums volition be raised, and the SR-22 will remain on your driving tape for at least three years.

Teen Driver Laws

To obtain your learner's license in the land of Nevada, you must be at least 15 years and six months of age. In order for teen drivers to obtain a license or restricted license, yous will demand to:

- Hold your learner's license at least 6 months

- Complete at to the lowest degree 50 hours of supervised driving time, x of which need to be at dark

- Be at least 16 years erstwhile

Restrictions during the intermediate or restricted license menses include:

- Y'all may not drive betwixt the hours of 10 P.M. and 5 A.M.

- Rider restrictions include only existence able to send family members, with no passenger existence under the age of 18

To accept these restrictions lifted, y'all must:

- Exist at least 18 years sometime to have the nighttime restrictions lifted

- You must hold your intermediate license or exist at least 18 years quondam to accept passenger restrictions lifted (whichever comes get-go), only must be no younger than xvi years and half dozen months of age

Older Driver and General Population License Renewal Procedure

Here's what you need to know about the older driver and general population license renewal procedures in the state of Nevada.

For older drivers, you lot must:

- Renew every four years if you are 65 or older

- Provide proof of acceptable vision at every renewal if age 71 or older

- Both mail and online renewals are permitted every other renewal if you lot are 65 or older

For the full general population, you must:

- Renew every viii years (upward until 2018, renewal was once every four years for individuals with odd number nascence years and once every 8 years for individuals with fifty-fifty number birth years)

- Provide proof of adequate vision if renewing in person

- Both mail and online renewals are permitted, but only if yous concord a four-year license

New Residents

If you're getting set up to move to The Silvery State, here's what y'all need to know well-nigh licensing laws for new residents in Nevada.

Upon applying for your Nevada commuter'southward license, y'all must provide:

- Proof of Identity

- Proof of Name Alter (if applicable)

- Proof of Social Security Number

- Proof of Nevada Residential Address

- Application for Driving Privileges or ID Menu

All documents must be original or certified copies issued in the U.S., saving for foreign passports.

For the lists of documents accepted for the above, visit the Nevada Department of Motor Vehicles Residency and Proof of Identity guide hither.

Negligent Operator Treatment System

In the majority of scenarios, a "reckless driving" accuse in Nevada constitutes a misdemeanor. That said, the penalties y'all could incur for such a accuse are based on the criminal offense you are ultimately convicted of.

Reckless driving is divers as:

- Driving in a daydreaming and willful manner without regard for the well existence of others or holding

- Street racing

- Refusing to yield to or avoiding a law enforcement officer

Additional traffic violations that could lead to a accuse of reckless driving if the act led to an auto accident with a cyclist or pedestrian include:

- Driving without caution or care with regards to cyclists and pedestrians

- Not yielding to a pedestrian at the crosswalk

- Disregarding a school crossing baby-sit's directions

- Driving to a higher place 15 mph or making a U-plow within a schoolhouse zone when school is however in session

- Speeding

For the kickoff kind of reckless driving mentioned, involving a willful disregard for the prophylactic of others and their property, potential penalties are:

- Outset conviction: Upwardly to six months of jail time and/or between $250 and $1,000 fines

- Second confidence: Up to six months of jail time and/or betwixt $1,000 and $one,500 fines

- Third conviction: Upwardly to six months of jail time and/or $1,500 and $two,000 fines

In addition to these penalties, drivers volition receive eight demerit points on their driving record. If you receive 12 or more points over the course of a year, this volition result in a interruption of your license for six months.

For the additional driving violations that fall under reckless behavior, potential penalties are:

- Get-go conviction: Up to 6 months of jail fourth dimension, $250 to $one,000 fines, and between fifty and 99 community service hours

- Second conviction: Up to six months of jail time, $i,000 to $1,500 fines, and between 100 and 199 community service hours

- Third conviction: Up to half dozen months of jail time, $1,500 to $2,000 fines, and 200 customs service hours

Likewise these penalties, drivers will also accept their license suspended for anywhere from six months to two years. It is up to the judge's discretion to request that the driver'due south vehicle be impounded for 15 days for a kickoff conviction and thirty days for whatever following convictions.

Nevada'south Rules of the Road

Now that you have a thorough agreement of Nevada'south vehicle licensing laws, information technology'south fourth dimension to delve into the state's essential rules of the road.

Allow's get things underway!

Mistake vs. No-Error

Nevada is a "fault" state, which means that the person who causes an auto standoff is responsible for covering the damages incurred equally a consequence, such equally medical bills, lost wages, etc. The at-fault party's insurance carrier will encompass these amercement until policy limits are exhausted.

Remember, if you are at fault for a collision, your personal avails could be in danger once your Nevada car insurance carrier's policy limits are wearied. This is why it is wise to consider conveying coverages above the land minimum to ensure you lot are fully protected.

Proceed Correct and Move Over Laws

Under Nevada Revised Statutes 484B.200, drivers should continue correct if driving slower than the average speed of traffic around them.

Nevada Revised Statutes 484B.267 requires drivers to yield the right of manner to emergency vehicles or official vehicles with flashing lights by driving parallel to, or equally almost as possible to, the correct curb or edge of the roadway. When yielding to an emergency vehicle, drivers should stay in this position until the emergency vehicle or official vehicle has gone by, unless directed to practise otherwise by law enforcement.

Speed Limits

The speed limit on rural interstates in Nevada is fourscore mph, but 65 mph for urban interstates. Drivers should attach to the speed limit of 70 mph on other express access roads and other roads.

Seat Belt and Carseat Laws

All children 6 years and older must be restrained by a safety belt. Violations incur a fine of $25 for first-time offenders.

Children 5 years and younger and weighing 60 pounds or less must be restrained in a child safety seat. An adult belt is non allowed. The maximum fine for first-time offenders is $500.

Nevada laws place restrictions on who may ride in the cargo area of pickup trucks. Exempt individuals must be xviii years of age or older. If younger than xviii, riding in a cargo expanse is authorized if the vehicle is used for ranching or farming or is being driven in an authorized parade. Oher exemptions include when the vehicle is operated on an unpaved road or passengers are enclosed in the cargo area by a camper beat out.

Ridesharing

Nevada Revised Statutes Chapter 706A encompasses ridesharing laws in the country, overseeing companies like Lyft and Uber. Rideshare services typically require all their drivers to carry personal policies at or above the state minimum for liability coverage.

While rideshare drivers seldom purchase an individual commercial insurance policy, companies like Uber offering $1 million in liability coverage for drivers. In fact, the bulk of rideshare companies maintain insurance fashion above the state minimum, which is good news for everyone involved.

Automation on the Route

Nevada has currently authorized the deployment of autonomous vehicles. Liability insurance is required for all democratic vehicle drivers. Nevada Revised Statutes Chapter 482A governs the regulation of autonomous vehicles in the state.

Whether or not autonomous vehicle operators must be licensed or in the vehicle is dependant on the vehicle'southward level of automation.

Nevada's Safety Laws

By now, you'll accept realized that there'south way more involved in staying safe on the road than just choosing the right automobile insurance provider. At this point, we're going to walk you through Nevada'south rubber laws to assist yous keep all the drivers in your family protected behind the wheel.

DUI Laws

Bank check out the video above regarding recent DUI legislation in the country of Nevada. To find out key data most Nevada's DUI laws, take a look at the data we've gathered below.

Marijuana-Impaired Driving Laws

Marijuana possession or consumption is one of the most frequent drug offenses in the land of Nevada. If you lot are arrested for a DUI, the responding officer has the right to ask for a claret test if he believes marijuana impairment was at play. The metabolites in marijuana stay in a person'due south bloodstream far longer than other types of drugs.

Nevada DUI legislation bars drivers from getting behind the wheel if they have a discernable amount of marijuana or the drug's metabolites in their blood over the legal threshold. Nevada Revised Statute Section 484C.110 prohibits drivers who are impaired by alcohol or a controlled substance like marijuana to drive or control a vehicle on public roadways, highways, or premises.

Nevada Revised Statute Section 484C.110(3) states that an private is unlawfully operating a vehicle while marijuana dumb if they have:

- Marijuana levels in their urine of at least 10 ng/ml

- Marijuana levels in their claret of at least 2 ng/ml

- Marijuana metabolite levels in their urine of at least 15 ng/ml

- Marijuana metabolite levels in their blood of at least 5 ng/ml

The employ of medical marijuana is permitted in Nevada if doctor-prescribed in specific cases. Still, if it is shown that y'all were impaired past marijuana consumption nonetheless and got behind the wheel, yous could still face a DUI conviction. In short, it is non advisable to consume marijuana and get out on the road, or you lot could open yourself up to serious legal repercussions.

Distracted Driving Laws

In the state of Nevada, all drivers are prohibited from using hand-held devices while behind the cycle. There is also a texting ban in place for all drivers.

Texting, using the internet, and operating hand-held devices while driving has been illegal in Nevada since 2011. Drivers are permitted to talk on the phone with hands-free devices. Drivers violating Nevada'south distracted driving laws face up a $50 fine for the showtime confidence in seven years, $100 for the following criminal offence, and $250 for all other offenses.

Fines may double if the distracted driving outcome occurred in a work zone. First offenses are not seen as moving violations. Check out the Nevada DMV's distracted driving manual for farther information.

Nevada Fascinating Facts You Need to Know

Set up for the top fascinating facts all Nevada drivers need to know? We thought and so.

First: Nevada is the state with the fewest crashes per capita due to bad atmospheric condition. We cover that and more in our 20 facts almost driving in bad atmospheric condition article.

Now, let's get to the residuum of those fascinating facts!

Vehicle Theft in Nevada

In 2013, there were 6,635 motor vehicle thefts in Las Vegas alone. Check out the FBI'due south State Crime Written report to see where your city ranks. Below are the top-10 stolen vehicles in the country of Nevada:

Risky/Harmful Driving Behavior

Below are fundamental stats regarding risky driving behaviors in the land of Nevada. You might be surprised by some of these.

Traffic Fatality Rates by City

2017 Traffic Fatalities

Fatalities by Person Type

Fatalities by Crash Type

Five Year Trend for the Top 10 Counties

Fatalities Involving Speeding past Top 10 Counties

Fatalities in Crashes Involving an Alcohol-Impaired Driver by Superlative ten Counties

Teen Drinking and Driving

European monetary system Response Time

Transportation

Did you lot know that the average Nevada resident has a commute fourth dimension of 23.i minutes? This is actually several minutes shorter than the commute time for the average U.Southward. employee of 25.3 minutes. That said, approximately 1.92 percent of workers in the state of Nevada take much longer commutes over 90 minutes.

Check out the most recent information revealing average auto ownership, commute time, and driver transportation stats in Nevada!

Car Ownership

Commute Time

Driver Transportation

Top Two Cities in Nevada for Traffic Congestion

The tabular array above shows the elevation two cities in Nevada for traffic congestion based on the INRIX 2018 Global Traffic Scorecard. Not surprising, considering Las Vegas and Reno are Nevada'southward kickoff and tertiary about populous cities.

Don't spend time stuck in traffic worrying nearly your Nevada car insurance rates.

Offset saving today! Become your FREE quote by comparing shopping with our online charge per unit figurer. Enter your Naught lawmaking below to get started!

Related Links

Source: https://www.carinsurancecomparison.com/nevada-car-insurance/

0 Response to "Reviews Tripe a Car Insurance John Kolias Las Vegas"

Post a Comment